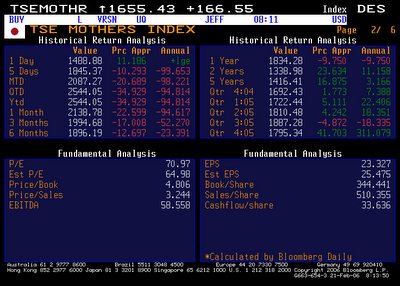

As with many things Japanese, the index's moniker lends itself to various amusing double entendres and picturesque puns that in all likelihood poingnantly express the feelings of aggrieved investors unfortunate enough to have held this index of securities of the past month, year, or, for that matter, five years, as exemplified in historical returns section (top right) of the second picture (source: Bloomberg LP) below. Despite the robust and wisdespread recovery in Japanese share values that has seen other small and mid-cap indices vault to new all-time highs, the hare-like (of Aesops fame) TSE Mothers has barely outpaced the meager returns yield by ZIRP deposits.

Yet despite the recent "Sherman's March" of prices, this Savannah-of-an-index seems to my frugal and conservative eye, to still lack the attributes I find attractive in an investment - chiefly some kind of tangible value or at least the likely delivery of value in the reasonably imminent future. Admittedly, the TSE Mothers has never been the place to look for such sober characteristics. Rather, it might be termed a "Godwanna of Growth", a "Fountain of Fashion", or a "Cornucopia of Dreams" since it's constituent members are indeed undertaking innovative and novel enterprise that often change and destroy historical business practices. And their leaders and employees are indeed youthful, vigourous and by many accounts, visionary. The only thing perhaps lacking (besides grey hair) are valuations commensurate with likely future cash flows that would reward an investor by bestowing upon her returns in the form of a stream of future dividends in combination with an enterprise sporting a future market value sufficiently higher than the amount initially paid to compensate her for her (in light of Livedoor) rather large if not total risk of loss.

Historically, such bush league enterprises as are Mothers' members would have remained in private hands until they yielded longer and more established records of profitability. But then "bungee jumping" and other thrill-seeking instant gratification sports didn't exist thirty years ago either. Investors sought these thrills. They DEMANDED them, jealous as they were of Masayoshi Son, Sergey Brin or Kleiner-Perkins. But then, people also DEMAND "Big Macs", HumVees and anything laden with the magical combination of sugar-coated trans-fats, so "the people" are not setting the bar very high.

Understand that I am not predicting the further demise of the Mothers. In this respect, growth and growth-oriented investors are, to my mind, from Neptune, and their fickle market whims and fancies cannot be easily fathomed using common or facile investment metrics. Suffice to say recovery is likely. Volatility is virtually assured. But the only thing that is truly certain is that I (and my investors and our collective investment pool) will NOT be present there.

No comments:

Post a Comment